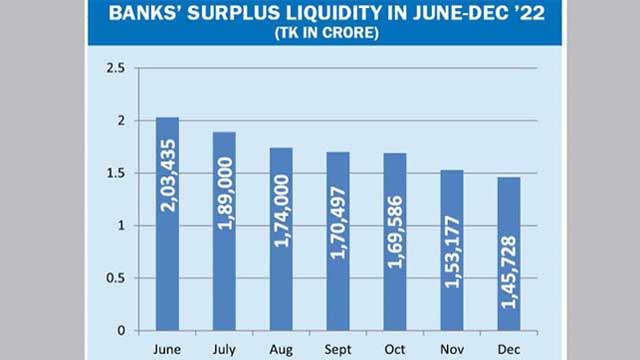

The amount of excess liquidity in the country’s banking sector plunged by Tk 57,707 crore to Tk 1.45 lakh crore at the end of December 2022 from that of June 2022.

Of the surplus liquidity in the banking sector, a few banks held the majority of the funds.

Banks’ liquidity kept falling due to a host of reasons, including high dollar sales by the Bangladesh Bank, low deposit rates, growing inflationary pressure and cash withdrawal in the wake of loan scams, bankers said.

According to Bangladesh Bank data, the amount of excess liquidity in banks was Tk 2,03,435 crore in June, since then it has dropped continuously to reach Tk 1,45,728 crore in December.

It dropped sharply to Tk 1.53 lakh crore in November from that of Tk 1.69 lakh crore in October 2022.

BB officials said that some banks, including Islami Bank Bangladesh, had witnessed a huge pressure of deposit withdrawal in recent months following media reports over various loan irregularities.

Various rumours about the sector’s situation added fuel to the fire, they said.

The BB issued notices urging the depositors not to withdraw funds in panic.

Besides, the dollar instability on the financial market had forced the BB to increase dollar sales significantly that eventually mopped up an equivalent amount of the local currency from banks that weighed heavily on liquidity in the banking sector.

The BB injected more than $7.8 billion in the financial system from July to December in 2022 in order to stabilise the foreign currency market and facilitate banks in making import payments obligations.

Due to the dollar sales, foreign exchange reserves dropped to $32.51 billion in December 2022 from record $48.6 billion in August 2021.

The surplus liquidity fell after the country’s import payments increased due to global supply chain problems, bankers said.

Amid liquidity shortage, interbank borrowing from the call money market has also increased in recent days.

The weighted average call money rate soared to 5.76 per cent at the end of December. It reached to 6.91 per cent on Tuesday.

Besides, a section of people with surplus funds stayed away from banks due to lower interest rates, the bankers said.

The weighted average interest rate on deposits of all banks was 4.22 per cent in November.

Many people rushed to withdraw their deposits and held cash in their hands amid inflationary pressure.

Rising living costs forced many low-income people to keep additional cash in hands, which eventually reduced liquidity in banks.

The amount of cash outside the country’s banks soared to record Tk 2.52 lakh crore in November from Tk 2.36 lakh crore.

The overall inflation soared to 9.52 per cent in August, the highest in a decade, which dropped to 9.1 per cent in September, 8.91 per cent in October, 8.85 per cent in November and 8.71 in December.

After the Russia-Ukraine war began in March 2022, the economy was hit by global supply chain disruption, hike in raw materials, currency devaluation and commodity price spiral.

After reaching 14.07 per cent, the private sector credit growth slowed as it was 13.93 per cent in September, 13.91 per cent in October and 13.92 in November and 12.8 in December.