Point-to-point inflation in February 2022 hit 6.17 per cent, 16-month high, as food prices have sharply gone up amid the prevailing high non-food inflation.

Food inflation climbed to 6.22 per cent and non-food inflation stayed slightly over 6 per cent during the second month of the current calendar year as overall inflation crossed 6 per cent twice in the past three months.

In December 2021, general inflation crossed 6 per cent for the first time in 14 months, according to the inflation update released by the Bangladesh Bureau of Statistics on Monday.

In October 2020, general inflation was recorded at 6.44 per cent by the BBS.

Economists, however, expressed reservation about the BBS inflation data, saying that actual inflation was much higher than the calculation.

Overall inflation could be double digit — a level seen only in the 2008-09 financial year amid a record commodity price hike on the global market — had the BBS calculated the data accurately, they remarked.

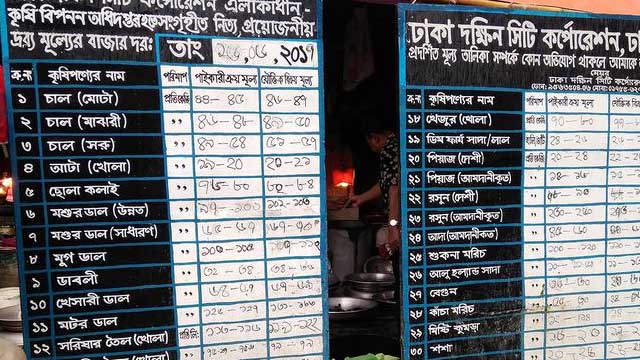

It has, meanwhile, been reported that many low-income people live on a single meal a day because of high food prices in the absence of recovery of their income lost due to the protracted Covid pandemic.

South Asian Network on Economic Modelling executive director Selim Raihan on Monday said that the skyrocketed prices of essentials were hardly reflected in the official data.

Although non-food inflation was recorded to be 6.1 per cent in February, the rate was shown surprisingly on a downward trend, he noted.

He went on to point out that high food inflation always pushed up non-food inflation.

On March 3, the SANEM in its report titled Inflation: Government Statistics vs the Reality of Marginal People claimed that the BBS had underestimated the actual increases in food prices by using the 2005-06 Household Income and Expenditure Survey data

The Centre for Policy Dialogue, another local think-tank, has been urging the government to change the base year and introduce a separate rate on food inflation on the basis of a shorter list of items.

State Minister for Planning Dr Shamsul Alam on Monday said that overall inflation in February slightly rose, but still it was within the tolerable level.

Besides, the country’s economic growth rate is good, he said, dismissing any major adverse impact on the economy due to the current trend of inflation.

BBS data, however, showed that 12-month average inflation between March 2021 and February 2022 was 5.59 per cent, slightly higher than the revised inflation rate of 5.5 per cent for the period.

A meeting of the Coordination Council on Budget and Resources, headed by finance minister AHM Mustafa Kamal, on December 22 decided to increase the inflation rate to 5.5 per cent in the current financial year from the projected 5.3 per cent due to the price hike of imported commodities and their impact on the local market.

The hike in the prices of edible oil, sugar, rice, flour has forced the government to expand distribution of subsidised food items to cover one crore poor households in urban and rural areas ahead of and during the month of Ramadan.

BBS data revealed that inflation in rural areas was much higher than in urban areas in February.

The BBS recorded 6.49 per cent overall inflation in rural areas, with 6.64 per cent food inflation and 6.15 per cent non-food inflation.

The BBS also recorded 5.59 per cent overall inflation in urban areas, with 5.30 per cent food inflation and 5.91 per cent non-food inflation.

Former World Bank Dhaka Office chief economist Zahid Hussain criticised the government for increasing the prices of kerosene and diesel by Tk 15 in early November on the pretext of fuel oils price hike on the global market.

The upward adjustment in the prices of fuel oils caused a massive adverse impact on the prices of both food and non-food items, he noted.

He warned that controlling inflation would be an uphill task if the government went for proposed energy price hike in the current financial year that expires in June.