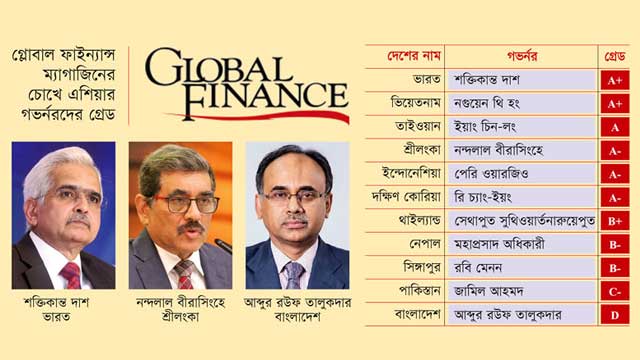

Bangladesh Bank governor Abdur Rouf Talukder has received a ‘D’ grade in a ranking on global central bank governors by Global Finance magazine due to his failure to effectively control inflation, manage the foreign currency market and stabilise reserves in the face of external pressures.

On Monday, Global Finance unveiled its 2023 ‘Central Banker Report Card’, where it has given Rouf a ‘D’ grade.

In the same ranking, neighbouring country India’s central bank- Reserve Bank of India governor Shaktikanta Das received an ‘A Plus’ grade.

Sri Lanka’s central bank governor Nandalal Weerasinghe received an ‘A Minus’, and Pakistan’s central bank governor Jameel Ahmad received a ‘C Minus.’

Bangladesh Bank spokesperson Mezbaul Haque declined to make any comments on the issue.

Global Finance has been evaluating governors of central banks from various countries worldwide since 1994.

In the latest report for the year 2023, central bank governors from 101 important countries were evaluated. Judgments were based on the governors’ performance from July 1, 2022 to June 30, 2023.

Global Finance editors, with input from financial industry sources, grade the world’s leading central bankers on a scale of ‘A’ to ‘F’, with ‘A’ being the highest grade and ‘F’ the lowest.

Receiving a ‘D’ grade by Rouf reflects concerns about the Bangladesh central bank’s ability to navigate and stabilise the economy in the face of significant external pressures.

The report indicated that in the first half of the review period, the Bangladesh Bank reasonably met its mandate.

The country experienced solid post-Covid GDP growth at 5.6 per cent, with inflation slightly surpassing the bank’s 5 per cent target by 0.6 per cent and the value of the Bangladeshi currency, the taka, remained stable.

However, by mid-2022, several challenges emerged. The taka was devalued by 9.5 per cent, leading to difficulties for importers due to a shortage of dollars.

Additionally, energy and food costs surged because of the conflict in Ukraine, contributing to high inflation.

The report observed that Bangladesh’s central bank had to use up a significant portion of its foreign exchange reserves, which led to a call for support from the International Monetary Fund (IMF).

The report also highlighted a structural weakness in the Bangladeshi economy and emphasised that the government’s 60 per cent control over the central bank created a vulnerability to external shocks, such as the inflationary impact experienced in 2022.

Among governors, only three received an ‘A Plus’ grade. The other two were Thomas Jordan, governor of the Central Bank of Switzerland, and Nguyen Thi Hong, governor of the Central Bank of Vietnam.