Two noted economists on Saturday warned that forced merger of weak banks would not bring any good results for the moribund banking sector unless reasons behind the moves are examined thoroughly.

They asked for proper scrutiny of the overall banking situation and reasons for lapses of previous rules and regulations before implementation of the proposed merger.

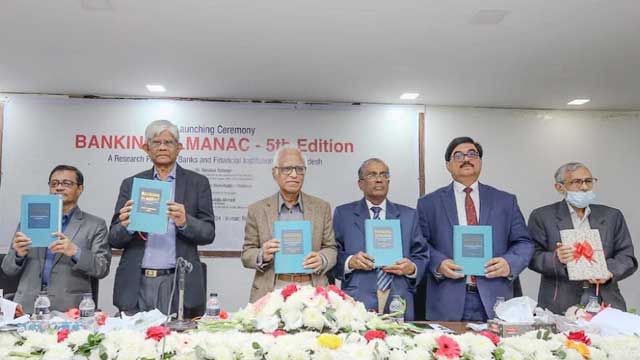

Wahiduddin Mahmud and Salehuddin Ahmed were speaking about the current situation in the banking sector during the launching of the 5th edition of Banking Almanac at Jatiya Press Club against the backdrop of recent moves by the Bangladesh Bank, aiming at improving the performance of the sector.

Calling the banking sector as the heart of the financial sector, Wahiduddin said that the condition of the financial sector is not good, reflected with the negative credit rating by the US Moody’s.

Control of a number of banks has gone under the grip of a single family in absence of anti-monopoly law, said Wahiduddin, also a former adviser to the caretaker government.

Many international standard rules and regulations were in practice in the banking sector but those rules are compromised nowadays, he lamented.

Many banking licences were given in the past one decade in the crowded banking sector despite protests from different sectors.

The central bank now plans to reduce the number of banks, he said, while referring to the recently announced BB policies to check bad loans and merger of weak banks.

It has been reported that the BB has identified around 20 banks out of 61 not performing well.

Wahiduddin, who led two banking sector commissions in the past, said that proper examinations are needed to know reasons behind lapses and deviations from the standard international practice in the sensitive banking sector.

Otherwise, the recent BB move to merging weak banks with strong banks will backfire, he said.

He warned that responsibility of weak banks should not be given on public banks.

‘It will cause damages,’ he said, while giving the example of the adverse situation faced by the economy due to extension of printing money by the BB to some of the weak banks in the recent period.

He also opposed deposit rate without any cap given the probable competition among weak banks to collect funds with bad consequences for depositors.

Salehuddin asked how weak banks could merge with strong banks.

Citing examples of other countries, he said that buying share of weak bank is a way. But in that case the strong banks would offer Tk 0.20 for the share of Tk 1.

‘It is very difficult’, said the former BB governor.

He was also critical regarding other steps announced by the BB recently to reduce bad loans in the banking sector.

The central bank reduced the loan written-off period to two years from previous three years that according to him created the scope for erasing Tk 43,000 crore from the book.

The banks are looking for that very scope, he said.

Referring to reasons for the financial crisis in the United States in 2007 identified by French economist Jean Tirole in his Nobel Prize winning book ‘Balancing the Banks’, he said country’s banking sector is facing setbacks because of growing indiscipline.

He expressed surprise about the recent narratives—corruption exists in many countries and inflation happens—made by many within the ruling party.

Giving examples of the US, he said that the offenders in the financial sector faced trials and received punishment. Referring to studies, he said that the convicts lost credit facility and faced poverty.

With the assistance from the BB, the Banking Almanac has been published since 2016 by ShikkhaBichitra.

Mohammed Nurul Amin, chairman of FAS Finance and Investment Limited and former chairman of Association of Bankers’ Bangladesh, and Shah Md Abdul Bari, additional managing director of EXIM Bank, also spoke on the occasion and highlighted the importance of the publication with important data of the banks.